Advanced Use of the Put-Call Ratio: Gauging Market Sentiment

Introduction

Understanding the put-call ratio is essential for anyone involved in options trading. This metric, calculated by dividing the volume of put options by the volume of call options, serves as a powerful indicator of market sentiment.

Market sentiment plays a crucial role in trading decisions. Knowing whether the market is bullish or bearish helps traders make informed choices and align their strategies accordingly.

In this article, you will explore:

- A recap of what the put-call ratio is and how it’s calculated.

- How to interpret market sentiment through this ratio.

- Advanced strategies for leveraging the put-call ratio in your trading approach.

- Challenges and considerations when using this tool.

- Real-life case studies illustrating successful trades.

To enhance your understanding of options trading, you might want to explore some resources on the Option Greeks, which measure the sensitivity of an option, or consider reading these 10 best books on options trading that can take your skills to the next level.

By the end, you will have a deeper understanding of how to use advanced techniques involving the put-call ratio to gauge market sentiment effectively.

1. Recap: Understanding the Put-Call Ratio

The put-call ratio is a crucial metric in options trading, offering insights into market sentiment. This ratio is calculated by dividing the volume of put options by the volume of call options within a specific time frame.

Definition: The put-call ratio (PCR) serves as an indicator of market sentiment. A higher PCR indicates a bearish outlook, while a lower PCR suggests bullish sentiment.

Calculation Method:

- Volume of Puts: This refers to the number of put options traded. Put options give the holder the right to sell an asset at a predetermined price, often utilized when traders expect prices to fall.

- Volume of Calls: This represents the number of call options traded. Call options allow the holder to buy an asset at a set price, typically used when traders anticipate rising prices. For more detailed information on how these contracts work, you can refer to our comprehensive guide on Call Options.

The formula for calculating the put-call ratio is:

Put-Call Ratio = Volume of Put Options / Volume of Call Options

Explanation of Put and Call Options:

- Put Options: Contracts that give traders the right, but not the obligation, to sell an asset at a specified price before the option expires. They are generally purchased when expecting asset prices to decline.

- Call Options: Contracts granting traders the right, but not the obligation, to buy an asset at an agreed-upon price within a certain period. These are usually bought when anticipating an increase in asset prices.

Understanding these foundational elements sets the stage for interpreting how shifts in the put-call ratio can signal broader market trends and investor sentiment. Additionally, it’s worth noting that there are various types of options brokers available in the market, each with unique features that may suit different trading styles.

Moreover, advanced strategies such as using delta hedging with straddle options or implementing a synthetic long options strategy, can be beneficial depending on market conditions. Understanding pricing models like the Black Scholes Model can also provide valuable insights into modern options pricing.

2. Understanding Market Sentiment with the Put-Call Ratio

The put-call ratio is a useful tool for gauging market sentiment. It compares the number of put options (contracts that give the holder the right to sell an asset) to call options (contracts that give the holder the right to buy an asset). Here’s how to interpret the ratio:

Bearish Sentiment: High Put-Call Ratio

A high put-call ratio often indicates bearish sentiment in the market. When traders purchase more put options than call options, it reflects a pessimistic outlook, anticipating a decline in stock prices. For instance, if the put-call ratio exceeds 1.2, it suggests that investors are heavily leaning towards protective strategies.

“The put-call ratio is a contrarian indicator. An extremely high ratio may signal excessive fear and an opportunity to buy.” – Market Analyst

Bullish Sentiment: Low Put-Call Ratio

Conversely, a low put-call ratio suggests bullish sentiment among traders. More call options being purchased than puts indicates an optimistic view of future market performance. Ratios below 0.7 generally point to confidence in rising stock prices.

Contrarian Strategies

Contrarian trading strategies play a crucial role in interpreting these signals. A contrarian investor might see an extremely high put-call ratio as an opportunity to buy, betting on an eventual market rebound when excessive bearishness reverses trend. Similarly, an extremely low put-call ratio might prompt a contrarian to sell or short stocks, anticipating that overly bullish sentiment could lead to a market correction.

These strategies can be further refined by understanding the role of market makers in options trading.

Informed Decision-Making

By assessing these ratios, you can gauge prevailing market moods and make informed decisions based on whether the majority of traders are showing signs of fear or greed. Balancing this analysis with other indicators enables a more nuanced approach to trading, enhancing your ability to navigate market fluctuations effectively.

Staying updated with reliable sources such as the stock market news can provide valuable insights and analysis on market movements which is essential for making informed trading decisions.

Additionally, understanding retail investors’ dynamic trading behavior can offer further insights into how different segments of the market react under various conditions, thereby refining your trading strategy even more effectively.

3. The Contrarian Approach to Trading with the Put-Call Ratio

Contrarian investing focuses on taking advantage of market inefficiencies by going against the prevailing sentiment. In options trading, this approach often involves finding opportunities where the market may have overreacted. The put-call ratio is a powerful tool for contrarian traders looking to identify these moments.

Key Principles of Contrarian Investing:

- Market Reversals: Contrarian investors look for signals that suggest an impending reversal in market trends.

- Extreme Sentiment: They focus on extreme bullish or bearish conditions, betting that the market will correct itself.

Using the put-call ratio, you can effectively identify these extremes:

- Bearish Extremes: When the put-call ratio rises significantly above 1.2, it indicates excessive bearish sentiment. This could signal that the market is oversold and a potential upward reversal is on the horizon.

- Bullish Extremes: Conversely, a put-call ratio that falls below 0.3 suggests extreme bullishness, hinting at an overbought market condition and potential downside correction.

By recognizing these extremes, contrarian traders position themselves ahead of market reversals, leveraging insights from the put-call ratio to make informed trading decisions. This strategy not only helps in capturing significant price movements but also in mitigating risks associated with following herd mentality in volatile markets.

Furthermore, understanding different options styles (https://www.fxoptions.com/fx-options-styles) such as American, European, and Bermuda can enhance your trading strategy. Each option style has its own set of rules regarding when it can be exercised, which is crucial information for any trader looking to maximize their profits and minimize losses.

4. Historical Context and Thresholds for Effective Trading Decisions Using the Put-Call Ratio

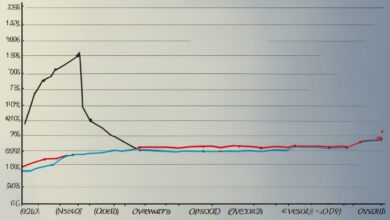

Historical extremes of the put-call ratio often correlate with significant market movements. For instance, during the 2008 financial crisis, the put-call ratio soared above 1.2, indicating extreme bearish sentiment. This spike presaged a massive sell-off, but also set the stage for an eventual market rebound as contrarian traders began to identify buying opportunities.

Another notable example occurred during the COVID-19 pandemic in March 2020. The put-call ratio surged as panic selling ensued, yet this extreme bearish signal was followed by a historic market recovery in the months that followed.

The equity-only put-call ratio is particularly significant for understanding individual investor sentiment. Unlike broader measures that include index options, the equity-only ratio focuses solely on stock options. This narrower scope can provide clearer insights into retail investor behavior, which is often more emotional and less driven by hedging strategies compared to institutional investors.

When interpreting historical data, thresholds can be valuable benchmarks:

- Values above 1.2: Often signal extreme bearishness.

- Values below 0.3: Typically suggest excessive bullishness.

Understanding these thresholds helps traders make informed decisions, leveraging historical context to gauge potential market inflection points effectively. It’s also crucial to understand the concept of intrinsic value when trading options as it plays a key role in determining whether to exercise an option or not. The intrinsic value of an option is essentially the difference between the current price of the underlying asset and the strike price, multiplied by the ratio.

Additionally, it’s important to note that while high put-call ratios typically indicate bearish sentiment, they can also serve as a signal for potential market reversals or recoveries. This is where understanding implied volatility becomes essential. Implied volatility often increases during periods of high put-call ratios, reflecting heightened uncertainty in the market. However, this increased volatility can also present unique trading opportunities for savvy investors who are able to navigate through the noise and identify undervalued assets poised for recovery.

5. Advanced Strategies for Leveraging the Put-Call Ratio in Your Trading Approach

Monitoring Trends for Sustained Shifts in Market Sentiment

Identifying sustained shifts in market sentiment requires careful observation of trends in the put-call ratio. A single day’s data might not accurately reflect the broader market mood. Instead, tracking how the ratio evolves over time can provide a clearer picture of underlying sentiment.

- Trend Analysis: Consistently high put-call ratios over several days suggest a bearish trend, while consistently low ratios indicate bullish sentiment.

- Behavioral Patterns: Recognizing patterns within these trends helps anticipate potential reversals or continuations, allowing for more informed trading decisions.

Utilizing a 10-Day Moving Average

A 10-day moving average of the put-call ratio smoothens out daily fluctuations, offering a clearer view of trends and helping to filter out short-term noise. This approach provides a more reliable indicator of market sentiment by focusing on longer-term movements.

- Calculation: Sum the put-call ratios of the past ten days and divide by ten. This creates a moving average that changes as each new day’s data is added.

- Application: A rising 10-day moving average indicates increasing bearish sentiment, while a falling average points to growing bullishness.

Combining Signals with Other Technical Indicators

To enhance the reliability of signals from the put-call ratio, combining it with other technical indicators like RSI (Relative Strength Index) can be highly effective.

- RSI Overview: The RSI measures overbought or oversold conditions in the market. Values above 70 suggest overbought conditions (potentially bearish), while values below 30 indicate oversold conditions (potentially bullish).

- Synergistic Approach:

- Bullish Signal: Low put-call ratio combined with an RSI below 30 suggests strong potential for upward movement.

- Bearish Signal: High put-call ratio coupled with an RSI above 70 points to possible downward volatility.

Practical Example

Consider a scenario where the put-call ratio has been steadily declining and sits at around 0.6, indicating bullish sentiment. If this trend is confirmed by an RSI value below 30, this dual confirmation increases confidence in predicting an upcoming market rally. Conversely, if both indicators suggest bearish conditions (high put-call ratio and high RSI), preparing for potential declines becomes prudent.

By integrating multiple indicators, you mitigate risks associated with relying on a single data point, thereby refining your trading strategies for better outcomes.

Monitoring trends, leveraging moving averages, and combining various technical indicators enable traders to make more nuanced decisions based on comprehensive analyses of market sentiment through the put-call ratio.

Additionally, understanding options trading can further enhance your strategy. For instance, selling a call option before its expiry date could be beneficial under certain circumstances. Moreover, being aware of the consequences of decreasing implied volatility can provide valuable insights into managing risks and maximizing returns in a volatile market.

6. Challenges and Considerations When Using the Put-Call Ratio as a Trading Tool

Interpreting the put-call ratio effectively involves navigating several challenges. One of the primary issues lies in data interpretation. The put-call ratio, while a powerful tool, requires context for accurate analysis. This means considering broader market conditions and macroeconomic factors alongside historical comparisons.

Broader Market Context and Macroeconomic Factors

The put-call ratio does not operate in isolation. Market sentiment can be influenced by external factors such as:

- Economic Indicators: GDP growth rates, employment statistics, and inflation figures can impact investor sentiment.

- Political Events: Elections, regulatory changes, and geopolitical tensions can sway market dynamics.

- Market Conditions: Bull and bear markets alter the baseline values for interpreting the put-call ratio.

Ignoring these factors can lead to misinterpretation of the data. For instance, during economic uncertainty, a higher put-call ratio might reflect protective hedging rather than outright bearish sentiment.

Timing Challenges

Timing is crucial when utilizing the put-call ratio for trading decisions. There are inherent challenges such as:

- Lagging Signals: The put-call ratio often reflects investor sentiment after significant price movements have occurred.

- False Positives: Short-term spikes or drops in the ratio may not always indicate sustained market trends but could be reactions to temporary events.

Using a 10-day moving average can help smooth out these fluctuations and provide a clearer picture of trend shifts. However, it’s important to recognize that like any other indicator, the put-call ratio has its limitations. For instance, much like the MACD indicator, it may depend heavily on historical data or produce false signals during certain market conditions.

Effective Entry and Exit Strategies

To capitalize on signals from the put-call ratio, defining precise entry and exit strategies is essential. Consider these approaches:

- Entry Strategies:

- Look for extreme values in the put-call ratio (e.g., above 1.2 or below 0.3) as potential reversal points.

- Combine the ratio with other technical indicators like Relative Strength Index (RSI) to confirm signals.

- Exit Strategies:

- Set predefined profit targets based on historical performance during similar sentiment phases.

- Use trailing stops to lock in gains while allowing room for further upside.

Risk Management Techniques

Effective risk management is critical to safeguard investments when trading based on the put-call ratio:

- Position Sizing: Limit exposure by keeping individual trade sizes within a manageable percentage of your portfolio.

- Stop-Loss Orders: Protect against unexpected market movements by setting stop-loss levels aligned with your risk tolerance.

- Diversification: Spread investments across different asset classes to mitigate risks associated with reliance on a single indicator.

Leveraging advanced techniques involving the put-call ratio demands an understanding of its limitations and challenges. By addressing issues related to data interpretation, timing challenges, entry and exit strategies, and risk management techniques, you can enhance your trading approach’s effectiveness and reliability.

Additionally, it’s worth exploring intraday options trading strategies(https://www.fxoptions.com/mastering-intraday-options-trading-strategies-considerations-and)

Case Studies: Real-Life Examples of Successful Trades Using the Put-Call Ratio as a Sentiment Gauge

Financial Crisis Case Study: 2008

During the 2008 financial crisis, many traders faced unprecedented volatility. An astute group of contrarian investors observed an exceptionally high put-call ratio, indicating widespread bearish sentiment. When the PCR escalated above 1.5, seasoned traders interpreted this as a signal of market panic. These traders took long positions in fundamentally strong stocks at depressed prices, anticipating a market rebound. As the market corrected over time, these positions yielded significant returns.

The strategy employed by these traders highlights the importance of understanding financial derivatives, which are financial instruments that have become integral to modern finance. Their value is derived from the performance of underlying assets and they can be used to hedge against risk or speculate on price movements. For instance, during this period, some traders may have chosen to exercise options, allowing them to buy or sell an asset at a predetermined price, thus capitalizing on the market rebound.

COVID-19 Pandemic

In early 2020, the COVID-19 pandemic triggered extreme market fluctuations. The put-call ratio spiked to levels unseen in years, reflecting intense fear among investors. Contrarian traders identified this surge as a potential reversal point. By monitoring the PCR alongside other indicators like the RSI (Relative Strength Index), they pinpointed oversold conditions and initiated strategic buys. This approach allowed them to capitalize on subsequent recovery phases as markets adjusted to new realities.

These case studies illustrate how understanding and leveraging the put-call ratio can provide critical insights during turbulent times, helping traders make informed and profitable decisions amidst market chaos.

Conclusion

Strategic use of the put-call ratio can significantly enhance your trading effectiveness. By integrating advanced techniques such as contrarian strategies and moving averages, you gain deeper insights into market sentiment. Combining the put-call ratio with other technical indicators like RSI provides a holistic view, enabling more informed and timely trading decisions.

Moreover, exploring advanced options strategies such as the iron butterfly can further boost your trading effectiveness. This well-crafted, risk-defined setup is an excellent addition to your trading arsenal.

Additionally, understanding option moneyness can unlock tactics for savvy trading. This knowledge equips you with key concepts and advanced strategies for maximizing your profits in the US market.

Mastery of these powerful tools equips you to navigate dynamic markets with confidence, aligning your trades with prevailing investor sentiment for better outcomes.