Delta Neutral Options: Definition, Use Cases, Examples

When it comes to options trading, one of the most popular strategies used by investors is delta neutral options. This approach involves creating a portfolio of options with a delta of zero, which means that the overall value of the portfolio is not affected by small changes in the price of the underlying asset. Delta neutral options can be incredibly useful for risk management purposes and are employed by traders across a range of markets.

In this article, we will provide a comprehensive overview of delta neutral options, exploring their definition, use cases, and examples. We will also dive into various options strategies and their importance in risk management.

Key Takeaways:

- Delta neutral options involve creating a portfolio of options with a delta of zero.

- Delta neutral options can be incredibly useful for risk management purposes.

- Traders across a range of markets employ delta neutral options.

- Options strategies are essential for effective risk management.

- Delta neutral options are just one of many strategies available to options traders.

Understanding Delta Neutral Options

Delta neutral options are a type of options trading strategy that involves minimizing the delta (the measure of an option’s price movement in relation to the underlying asset) to create a market-neutral position. Options trading enables investors to profit from market fluctuations, but it also involves a considerable amount of risk. Delta-neutral options minimize this risk by balancing an investor’s position in options and the underlying asset.

Options pricing is a crucial aspect of delta-neutral options. It involves calculating the value of an option based on various factors such as the underlying asset’s price, time to expiration, interest rates, and volatility. Option pricing models like the Black-Scholes model help investors calculate fair value for their options positions.

In delta-neutral options, option hedging is used to minimize risk. Hedging involves taking offsetting positions in different securities or markets to reduce the overall risk of one’s portfolio. Delta hedging involves using options contracts to offset the directional risk of an underlying asset. The goal is to achieve a delta-neutral position, where any changes in the market price of the underlying asset are offset by changes in the options position.

Option Greeks, such as Delta, Gamma, Theta, and Vega, play a critical role in option pricing and hedging. These measures help investors understand and manage the risks involved in trading options. Delta measures the change in the option price concerning the underlying asset price, Gamma measures the option delta’s rate of change, Theta measures the time decay of an option’s value, and Vega measures an option’s sensitivity to changes in volatility.

Delta-Hedged Strategies for Market Neutrality

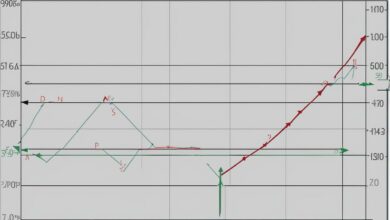

Delta-hedged strategies are a popular approach to achieving market neutrality in options trading, where the overall delta value of a portfolio is maintained at zero. This technique involves balancing the positive and negative delta positions of options contracts to reduce directional risk and protect the portfolio from market volatility.

Volatility adjustment is a key component of delta-hedged strategies. Since options prices are influenced by changes in volatility, market participants adjust their positions to account for changes in the implied volatility of the underlying asset. This helps traders maintain the desired level of market neutrality and avoid large losses due to sudden changes in volatility.

Gamma neutral positions are another important aspect of delta-hedged strategies for market neutrality. Gamma represents the rate of change of an option’s delta value, and traders can adjust their positions to maintain a gamma neutral portfolio. This means that the overall delta value of the portfolio remains constant, even if the underlying asset’s price changes. This strategy is particularly helpful in mitigating risk in fast-moving markets.

Example of Delta-Hedged Strategy

Let’s consider a hypothetical example where an options trader has a portfolio with a delta value of +1000. To maintain market neutrality, the trader sells options with a delta value of -1000, effectively balancing the overall delta value at zero. If the underlying asset’s price increases, the delta value of the trader’s original position also increases. To counter this, the trader can purchase options with a positive delta value to maintain the overall delta value at zero.

Delta-hedged strategies are effective in reducing directional risk, but they are not foolproof. Sudden changes in volatility or unexpected market movements can still lead to losses. As with any options strategy, risk management is crucial, and traders must constantly monitor their positions to ensure they remain market neutral.

Hedging Strategies for Risk Arbitrage

When it comes to risk arbitrage, it’s essential to have effective hedging strategies in place to minimize losses and maximize gains. Two popular hedging strategies used in risk arbitrage are synthetic options and strike price hedging.

Synthetic Options

Synthetic options allow an investor to replicate the payoff of an option by trading a combination of other options and underlying assets. This strategy is often used when the desired option is not available in the market, or when the cost of the desired option is too high.

For example, suppose an investor wants to take advantage of a short-term price discrepancy between two securities. In that case, the investor may purchase the cheaper security and sell the more expensive security simultaneously. By using synthetic options, the investor can offset any potential losses if the price discrepancy does not materialize as expected.

Strike Price Hedging

Strike price hedging is another popular hedging strategy used in risk arbitrage. This involves the simultaneous purchase of one option and the sale of another option with a different strike price but the same expiration date.

For example, suppose an investor believes that the stock price of a company will increase over the next three months. In that case, the investor may purchase a call option with a strike price of $50 and sell a call option with a strike price of $55. If the stock price does increase as predicted, the investor will be able to buy the stock at $50 and sell it at $55, earning a profit. If the stock price fails to increase, the investor can sell the stock and minimize losses.

Overall, these hedging strategies aid in risk management, enabling investors to maximize gains and minimize losses in volatile market conditions.

Options Analysis and Neutral Portfolio Construction

Options analysis is a critical component of constructing a neutral portfolio. By analyzing various options strategies and their risk-reward ratios, traders can make informed decisions about which positions to take and how to balance their overall portfolio.

Neutral portfolio construction typically involves a combination of long and short positions in different assets. The goal is to create a portfolio that is not impacted by changes in the overall market, but rather by shifts in the relative value of individual securities.

Options Analysis

Options analysis involves evaluating the potential profitability of different options strategies. One of the most important metrics used in this analysis is the risk-reward ratio. This ratio compares the potential profit from a position to the potential loss, helping traders determine whether a particular strategy is worth pursuing.

Another key factor to consider in options analysis is the volatility of the underlying asset. This is measured by the “implied volatility” of the options, which reflects the expected magnitude of future price movements. Traders may use this information to determine which strategies are most appropriate given current market conditions.

Neutral Portfolio Construction

Construction of a neutral portfolio involves selecting a combination of long and short positions that will effectively balance each other out. This may involve taking long positions in undervalued assets, while simultaneously taking short positions in overvalued assets.

Another common strategy for neutral portfolio construction is delta-neutral hedging. This involves taking offsetting positions in options and the underlying asset, such that the overall delta (or sensitivity to price movements) is zero. By doing so, traders can limit their exposure to overall market fluctuations, while still taking advantage of opportunities in individual securities.

Risk Management

Effective risk management is critical when constructing a neutral portfolio. Traders must be vigilant in monitoring the performance of their positions and adjusting them as needed to maintain balance and minimize risk.

One key risk management strategy is to set stop-loss orders for each position. These orders automatically trigger the sale of a position once it reaches a certain price, limiting potential losses in the event of market downturns.

Another strategy is to regularly rebalance the portfolio by adjusting positions as needed to maintain target weightings. This can help avoid overconcentration in any one asset or sector, reducing the overall risk of the portfolio.

Conclusion

In conclusion, delta neutral options are a crucial aspect of options trading. These options provide an effective way to manage risk while maintaining a balanced portfolio. The use of volatility trading and other hedging strategies helps in achieving market neutrality and reducing the impact of market fluctuations on investments.

It is important to note that options trading can be complex, and it requires a thorough understanding of options pricing, hedging, and risk management. Therefore, it is essential to conduct options analysis and construct a neutral portfolio to ensure that trading decisions are based on sound logic and a clear understanding of market conditions.

Overall, delta neutral options can be a valuable tool for traders looking to manage risk and achieve market neutrality. However, it is crucial to understand its underlying concepts and implement it with a clear strategy to reap the benefits.

FAQ

What are delta neutral options?

Delta neutral options refer to a trading strategy where the overall delta value of a portfolio is kept close to zero. This means that changes in the underlying asset’s price will have minimal impact on the value of the options. It is achieved by adjusting the ratio between options and their corresponding underlying assets.

What are some use cases for delta neutral options?

Delta neutral options are commonly used for various purposes, including risk management, hedging, and volatility trading. They allow traders to protect their portfolios against adverse price movements and take advantage of opportunities in different market conditions.

Can you provide some examples of delta neutral options strategies?

Some examples of delta neutral options strategies include straddles, strangles, and iron condors. These strategies involve combining options with different strike prices and expiration dates to create a balanced portfolio with minimal directional bias.

How do delta neutral options strategies help in risk management?

Delta neutral options strategies help manage risk by reducing the sensitivity of a portfolio to price movements in the underlying asset. By maintaining a near-zero delta, traders can minimize their exposure to directional risk and potentially limit losses in volatile market conditions.

What is option hedging and why is it important?

Option hedging involves using options to offset or reduce the risk associated with an existing position. It allows traders to protect their portfolios from adverse price movements and potentially profit from changes in volatility. Option hedging is important in risk management as it helps minimize potential losses and increase the consistency of returns.

What are option greeks and how do they relate to risk management?

Option greeks are measures that quantify the sensitivity of an option’s price to various factors, such as changes in the underlying asset’s price, volatility, time, and interest rates. They play a crucial role in risk management as they provide insights into the potential risks and rewards associated with different options strategies.

What are delta-hedged strategies for market neutrality?

Delta-hedged strategies for market neutrality aim to create a position where the delta value of a portfolio is neutral or close to zero. These strategies involve adjusting the ratio between options and the underlying asset to minimize the impact of price movements. They are used to capture the volatility premium and profit from changes in implied volatility.

What is volatility adjustment in delta-hedged strategies?

Volatility adjustment is a technique used in delta-hedged strategies to account for changes in implied volatility. As implied volatility increases or decreases, the hedge ratio between options and the underlying asset is adjusted to maintain a delta neutral position. This helps traders capitalize on volatility fluctuations and potentially enhance their returns.

How do gamma neutral positions relate to delta neutral options?

Gamma neutral positions are closely related to delta neutral options strategies. While delta measures the rate of change of an option’s price with respect to changes in the underlying asset’s price, gamma measures the rate of change of delta. By maintaining a gamma neutral position, traders can keep their delta value stable and effectively manage risk.

What are hedging strategies used in risk arbitrage?

Hedging strategies used in risk arbitrage involve offsetting the risks associated with merger and acquisition transactions. These strategies often involve using synthetic options, such as options on stock indices or exchange-traded funds, and employing techniques like strike price hedging to mitigate potential losses and increase the likelihood of profitable outcomes.

How does risk management play a role in hedging strategies?

Risk management is essential in hedging strategies as it helps identify and evaluate potential risks associated with market movements and trading activities. By hedging against these risks, traders can reduce their exposure to market fluctuations, protect their capital, and increase the overall stability and profitability of their positions.

What is options analysis and how does it contribute to neutral portfolio construction?

Options analysis involves evaluating the characteristics and potential risks and rewards of options contracts. It helps traders assess different options strategies, analyze the impact of various factors, such as changes in volatility and time decay, and make informed decisions when constructing a balanced and neutral portfolio. Options analysis is crucial in managing risk and optimizing returns.

Why is risk management important in maintaining a balanced portfolio?

Risk management is crucial in maintaining a balanced portfolio as it allows traders to protect their investments from unexpected market movements and potential losses. By implementing risk management strategies, such as diversification, hedging, and position sizing, traders can reduce their exposure to market risks and ensure a more stable and consistent performance of their portfolio.