Harnessing the Power of Gamma Scalping: Techniques and Best Practices

Did you know that gamma, the second derivative of option price, is positive for both call and put options? This fact is crucial for understanding gamma scalping in options trading. We’ll explore how traders can use gamma to their benefit in different market conditions.

Gamma scalping is a key strategy in options trading. It involves using changes in gamma levels to make profits. Traders adjust their positions based on market volatility to capture short-term price changes. This strategy needs a good grasp of gamma risk and delta hedging.

In options trading, gamma is known as the “accelerator.” It shows how an option’s delta changes with the asset’s price. Knowing gamma well is key to managing risk and making the most of options markets.

We’ll look at how gamma scalping works in various markets, from high to low volatility. By understanding this strategy, traders can adjust their tactics for different market conditions. This could lead to more consistent profits.

Key Takeaways

- Gamma is positive for both call and put options

- Gamma scalping exploits changes in gamma levels for profit

- Understanding gamma risk is crucial for effective delta hedging

- Gamma scalping requires continuous position adjustment

- The strategy can be adapted to various market volatility conditions

- Mastering gamma is essential for risk management in options trading

The Concept of Gamma Scalping

Gamma scalping is a strategy for options trading. It means adjusting positions to make money from small price changes in the asset. Traders use this method to take advantage of gamma trading while keeping risks low.

This strategy needs traders to watch and change their option positions often. For instance, a trader might start with a long premium position, where the option’s delta is near 0.25. They would then sell 25 lots of the asset for every 100 options contracts they hold to get delta neutrality.

When the market changes, traders must adjust their positions to stay delta-neutral. They might buy or sell the asset based on price changes. The aim is to make money from these small changes while managing risk.

| Scenario | Action | Outcome |

|---|---|---|

| Price increase | Sell underlying | Profit from delta adjustment |

| Price decrease | Buy underlying | Profit from delta adjustment |

| No price change | No action | Potential loss from theta decay |

Gamma scalping can be profitable but has risks. Traders must think about transaction costs, losses from theta decay, and big price moves. To succeed, they need to understand options Greeks and market trends well.

Benefits of Gamma Scalping in Options Trading

Gamma scalping brings big benefits to options trading. It uses small price changes to make steady profits. It also helps manage risks well. Let’s look at why gamma scalping is a good choice for traders.

Potential for Consistent Profits

Gamma scalping makes money from small, frequent price changes. By keeping a balanced position and adjusting it, traders can earn steady profits. This works best when the market moves more than the options suggest.

Risk Management Advantages

Gamma scalping is great for managing risks. By adjusting positions often, traders keep their risk balanced. This helps reduce losses from time-value changes in calm markets.

Flexibility in Market Conditions

Gamma scalping is flexible for different market conditions. It works well in both high-volatility and steady markets. Traders can change their strategy as the market moves, making it a flexible tool.

| Market Condition | Gamma Scalping Approach |

|---|---|

| High Volatility | Frequent adjustments, larger profit potential |

| Low Volatility | Fewer adjustments, focus on minimizing theta decay |

| Sideways Market | Capitalize on small price oscillations |

Gamma scalping needs close watch and often changing positions. Yet, it offers steady profits, strong risk management, and flexibility for different markets. This makes it a top choice for traders looking to improve their skills.

Key Components of Successful Gamma Scalping

Gamma scalping is all about three main things: picking the right options, deciding how big to bet, and analyzing the market. Let’s see how these parts work together for a strong trading plan.

Choosing the right options is key to gamma scalping. We pick options with high gamma, usually those that are close to the market price. These options change a lot with the market, giving us chances to make money.

How much to bet is crucial for managing risk. We figure out the number of contracts based on how much we can afford to lose and our account size. This keeps us balanced, which is important for gamma scalping.

Keeping an eye on the market is essential. We watch price changes, how volatile they are, and how time affects option prices. This helps us make smart moves, taking advantage of short-term trends while keeping losses small.

- Delta shows how much an option’s price changes with the asset’s price

- Gamma is the rate of delta’s change

- Theta is the effect of time on option prices

By using these elements, we make a flexible gamma scalping strategy. This lets us handle different market situations, balancing risk and reward. Remember, gamma scalping needs discipline, ongoing learning, and being ready to adapt to market changes.

Gamma Scalping Strategies for Different Market Scenarios

Gamma scalping is a flexible trading strategy for various market conditions. We’ll look at how to use it in high and low volatility, and sideways markets.

High Volatility Environments

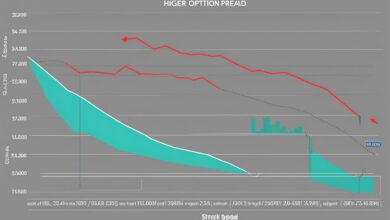

In high volatility markets, gamma scalping works well. Traders use options with high gamma to make the most of big price changes. For example, a $22 strike call’s delta can jump from 0.25 to 0.40 with a $1 stock price increase. This makes for more trading opportunities and potential profits.

Low Volatility Periods

During low volatility, gamma scalping involves selling options with lower gamma. This method benefits from time decay and reduces the risk of sudden price moves. Traders adjust their positions less often, focusing on longer-term spreads for steady income.

Sideways Market Conditions

In sideways markets, gamma scalping can be used with range-bound trading. By keeping a neutral gamma exposure, traders can profit from small price changes within a range. They set up options with balanced positive and negative gamma for consistent adjustments as the market moves.

Successful gamma scalping in any market requires constant monitoring and adjusting. Traders need to keep up with market volatility and be ready to change their strategies. By adapting to different markets, gamma scalping can offer profit opportunities in various trading conditions.

Tools and Platforms for Effective Gamma Scalping

Gamma scalping needs advanced tools for complex strategies. We use options analytics software for real-time data and trading algorithms. These tools are key for successful gamma scalping.

Platforms like thinkorswim and Interactive Brokers offer detailed options analysis. They provide real-time Greeks calculations to keep delta-neutral positions. With customizable charts, traders can quickly analyze the market and adjust strategies.

Important features for gamma scalping platforms include:

- Real-time market data feeds

- Advanced options analytics

- Automated trading algorithms

- Low-latency execution capabilities

- Risk management tools

Let’s compare some popular platforms:

| Platform | Real-time Data | Options Analytics | Trading Algorithms |

|---|---|---|---|

| thinkorswim | Yes | Advanced | Custom scripting |

| Interactive Brokers | Yes | Comprehensive | API integration |

| OptionsXpress | Yes | Intermediate | Limited |

Choosing the right platform is crucial for gamma scalping success. Look at data accuracy, speed, and analytical tools when picking your trading software.

Common Pitfalls in Gamma Scalping and How to Avoid Them

Gamma scalping can be profitable but has its challenges. Let’s look at common pitfalls and how to avoid them. This will help improve our risk management and trading discipline.

Overtrading and Transaction Costs

Overtrading is a big issue in gamma scalping. It involves buying and selling too much, which increases transaction costs. These costs can eat into our profits. To avoid this, we should balance our trades with the potential gains carefully.

| Trading Frequency | Transaction Costs | Potential Impact |

|---|---|---|

| High | Significant | Erodes profits |

| Moderate | Balanced | Optimal returns |

| Low | Minimal | Missed opportunities |

Mismanaging Delta Exposure

Ignoring delta exposure can lead to unwanted risk. For example, a 30% delta means our portfolio acts like 0.30 shares of the stock. We must keep an eye on our positions and adjust them to stay delta-neutral.

Ignoring Other Greeks

While focusing on gamma, we can’t ignore other Greeks. Theta, which represents time decay, and vega, which measures volatility sensitivity, are important. For instance, out-of-the-money puts are riskier during sudden stock moves because of gamma. Understanding all Greeks is vital for managing risks in options trading.

Advanced Gamma Scalping Techniques

We’ve looked at the basics of gamma scalping. Now, let’s get into advanced techniques. Using multi-leg options strategies like iron condors or butterflies helps us create complex gamma profiles. This way, we can adjust our trading to fit the market better.

Volatility trading is crucial for advanced gamma scalping. By looking at the difference between expected and actual volatility, we can find ways to make money. Tools like Market Chameleon’s ‘Pro’ account help us compare these ratios and spot good trades.

Gamma hedging lets us keep a certain level of gamma while managing risks. This means we adjust our options portfolio often to secure profits and reduce losses. By managing our delta positions well, we can deal with time decay and profit from short-term price changes.

Gamma scalping at a high level needs a deep understanding of gamma, delta, and volatility. It’s for experienced traders who can watch the market closely and act fast. With practice and analysis, these advanced methods can improve our trading skills and increase our earnings.