Integrating Elliott Wave Theory into Options Trading Strategies

Unlocking Market Trends: How Can Elliott Wave Theory Revolutionize Your Options Trading Game?

Ever wondered how Elliott Wave Theory can potentially transform your options trading strategies? This powerful form of technical analysis, developed by Ralph Nelson Elliott in the 1930s, identifies repetitive wave patterns in market prices, reflecting collective investor psychology. By understanding these wave cycles, traders gain valuable insights into market trends.

Key Benefits of Integrating Elliott Wave Theory into Options Trading:

- Identifying Entry and Exit Points: Recognize optimal moments to enter or exit trades based on anticipated market movements.

- Enhanced Decision-Making: Use wave structures to fine-tune strike prices and expiration dates.

- Risk Management: Employ strategies like synthetic long options during volatile conditions predicted by wave analysis. These strategies can be particularly useful when decreasing implied volatility is a concern.

Incorporating Elliott Wave Theory into your options trading arsenal can unlock new levels of precision and profitability.

Decoding the Waves: Understanding the Building Blocks of Elliott Wave Theory

Elliott Wave Theory, developed by Ralph Nelson Elliott in the 1930s, is a powerful tool for predicting market movements based on wave patterns. These patterns are a reflection of collective investor psychology, which tends to operate in repetitive cycles.

Types of Waves:

1. Impulsive Waves:

These waves drive the primary trend and consist of five sub-waves labeled 1, 2, 3, 4, and 5. Within this structure:

- Waves 1, 3, and 5 are motive waves pushing the trend forward.

- Waves 2 and 4 are corrective waves providing temporary retracements.

2. Corrective Waves:

These counter-trend waves typically unfold in three sub-waves labeled A, B, and C. They serve to correct the primary trend established by impulsive waves.

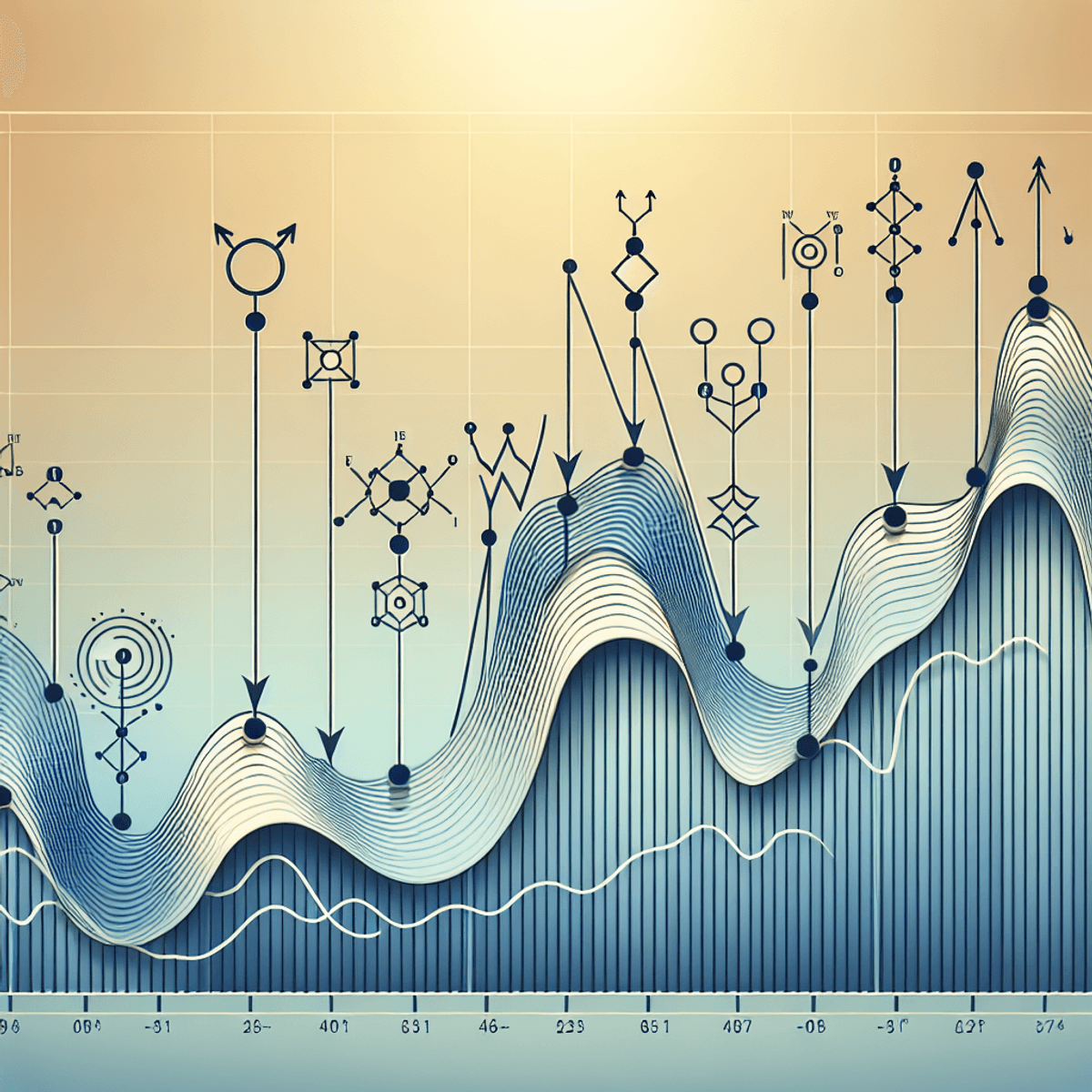

The Complete 8-Wave Cycle:

A full Elliott Wave cycle includes both impulsive and corrective phases, forming an eight-wave sequence:

1. Impulsive Phase:

- Wave 1: Initial thrust in the direction of the trend

- Wave 2: Partial retracement

- Wave 3: Strongest and longest push

- Wave 4: Another partial retracement

- Wave 5: Final push in the direction of the trend

2. Corrective Phase:

- Wave A: Initial counter-trend move

- Wave B: Temporary reversal back towards the trend

- Wave C: Concluding counter-trend move completing the correction

Understanding this complete cycle is crucial for analyzing market behavior and identifying potential entry and exit points in options trading strategies.

While Elliott Wave Theory offers a comprehensive framework for market analysis, it’s important to recognize certain limitations when using technical indicators like MACD alongside this theory.

Additionally, market behavior can be influenced by various factors including news updates.

Identifying High-Probability Trading Setups with Elliott Wave Theory

Mastering Entry Points: Capitalizing on Impulsive Waves for Profitable Trades

Identifying high-probability trading setups is crucial in options trading. The Elliott Wave Theory provides a robust framework for making informed decisions, particularly during the early stages of impulsive waves. Here’s how to effectively leverage this technique:

1. Recognize the Start of an Impulsive Wave

The first step involves accurately identifying the beginning of an impulsive wave. Key indicators include:

- Breakout Patterns: Look for price action breaking through resistance or support levels.

- Volume Spikes: Increased trading volume often accompanies the start of a new trend.

- Technical Indicators: Use moving averages, MACD, and RSI to confirm the onset of an impulsive wave.

2. Entering Long Positions

Once an impulsive wave is identified, traders can capitalize by entering long positions. Practical strategies include:

- Buying Call Options: This strategy allows traders to benefit from the upward price movement characteristic of impulsive waves.

- Bullish Vertical Spreads: Combining buying and selling call options at different strike prices within the same expiration can optimize risk-reward ratios.

For those looking to delve deeper into such strategies, exploring intraday options trading strategies can provide valuable insights.

3. Timing Your Entries

Optimal timing is essential to maximize profit potential:

- Wave 1 Entry Point: Entering at the start of Wave 1 offers high rewards but comes with higher risk due to less market confirmation.

- Wave 2 Pullback: Often seen as a safer entry point, after a minor correction within an impulsive move.

- Wave 3 Confirmation: Typically the strongest wave, entering at its inception can yield substantial returns with relatively lower risk.

4. Managing Risk

Effective risk management is paramount:

- Stop-Loss Orders: Place stop-loss orders below key support levels identified through prior corrective waves.

- Position Sizing: Adjust position sizes based on volatility and overall market conditions.

5. Utilizing Fibonacci Ratios

Incorporate Fibonacci ratios to refine entry points and target levels:

- Retracement Levels: Identify pullbacks (Wave 2) that align with Fibonacci retracements (38.2%, 50%, and 61.8%).

- Extension Levels: Use Fibonacci extensions to set profit targets for Waves 3 and 5.

By integrating these strategies into your options trading approach, you can significantly enhance your ability to pinpoint high-probability setups during market reversals and trend continuations driven by Elliott Wave Theory.

Safeguarding Profits: Exiting Positions Strategically During Corrective Waves

Effective exit strategies during corrective waves are crucial for protecting profits and managing risk in Elliott Wave Theory options trading. As market reversals become imminent, traders can leverage this theory to spot potential shifts and make more informed decisions.

Some key strategies include:

- Using Protective Puts: Implementing protective puts can help lock in profits as the market begins to correct. By purchasing a put option, traders can hedge against potential losses, ensuring they retain gains from prior impulsive waves.

- Identifying Wave Patterns: Recognizing the formation of corrective waves (labeled A, B, and C) allows traders to anticipate downturns. For instance, exiting long positions or selling calls as Wave A forms can mitigate potential losses.

- Setting Stop-Loss Orders: Establishing stop-loss levels based on Fibonacci retracement ratios provides a systematic approach to exiting trades. This method ensures that once prices hit predetermined levels, positions are closed to prevent further loss.

- Monitoring Volume: Observing volume changes during corrective waves offers additional confirmation. Diminishing volume often signifies a weakening trend, indicating it’s time to exit.

- Understanding Option Moneyness: Familiarity with Option Moneyness is essential for advanced strategies. This concept helps traders maximize their profits by understanding how the intrinsic value of options changes with market conditions.

Combining these strategies helps traders navigate corrections efficiently. By maintaining vigilance over wave patterns and market signals, they can safeguard their profits and enhance their overall trading performance.

Enhancing Accuracy with Fibonacci Ratios: A Powerful Tool for Traders

Fibonacci ratios, when combined with Elliott Wave Theory, provide traders with a powerful tool to identify high-probability trading setups. These ratios help in identifying important price levels that can be used as entry points, exits, and stop-loss placements.

Using Fibonacci retracement levels in your analysis allows you to identify potential market reversals and make better trading decisions. For instance, when an impulsive wave comes to an end, traders often look for the following corrective wave to retrace to specific Fibonacci levels—such as 38.2%, 50%, and 61.8% — before continuing the original trend.

Practical Applications:

- Entry Strategies: Use Fibonacci levels to find the best points for entering long positions. For example, buying calls around the 50% retracement level of a corrective wave can increase the chances of capturing the next impulsive move.

- Support Levels: Fibonacci ratios can also act as support levels during corrections. If a corrective wave reaches a 61.8% retracement level and holds, it indicates strong support, suggesting a low-risk entry point.

- Stop-Loss Orders: Placing stop-loss orders just beyond key Fibonacci levels ensures risk management by cutting losses if the market doesn’t behave as expected.

By combining Elliott Wave Theory with Fibonacci ratios, traders can improve their strategies and increase accuracy in Elliott Wave Theory options trading. This combination allows traders to align their actions with market psychology, making it easier for them to navigate complex market movements effectively.

Moreover, with the rise of innovative trading strategies like 0DTE options, incorporating these tools can further enhance trading outcomes by allowing for more precise timing and execution in fast-moving markets.

Overcoming Challenges and Mastering Complexity: Practical Tips for Successful Application of Elliott Wave Theory in Options Trading

Navigating Subjective Wave Interpretation

Elliott Wave Theory, while powerful, is inherently subjective. Traders often face challenges in accurately identifying wave patterns due to the subtle nature of market movements. Complex wave structures further complicate this task, making it crucial to approach wave interpretation with a careful eye.

Practical Tips for Clarity:

- Start Simple: Beginning with basic wave patterns helps build foundational skills before tackling more intricate structures.

- Use Clear Guidelines: Follow established rules such as the length and duration of waves to maintain consistency.

Leveraging Technical Indicators for Confirmation

To reduce subjectivity and improve accuracy, incorporating additional technical indicators can validate wave counts and provide stronger trading signals.

Effective Indicators Include:

- Relative Strength Index (RSI): Helps confirm overbought or oversold conditions that align with wave terminations.

- Moving Averages: Aid in identifying trend directions, supporting the confirmation of impulsive versus corrective waves.

“The combination of Elliott Wave Theory with other technical tools leads to more robust trading decisions.”

Validation Techniques for Enhanced Accuracy

Using validation techniques ensures that the identified wave structure is reliable and not a misinterpretation.

Recommended Validation Methods:

- Fibonacci Ratios: Use these ratios to ascertain potential retracement levels and price targets within the wave structure.

- Volume Analysis: Higher volume typically accompanies impulsive waves, while corrective waves often see diminishing volume—this distinction aids in accurate identification.

Incorporating Advanced Options Strategies

As traders become more comfortable with Elliott Wave Theory, they may consider exploring advanced options strategies such as the Iron Butterfly options. This well-crafted, risk-defined setup can significantly boost trading strategies when applied correctly.

Real-World Case Studies: How Traders Have Used Elliott Wave Theory in Options Trading

Brexit Referendum (2016)

The Brexit referendum in 2016 brought extreme volatility to financial markets. Traders who applied Elliott Wave Theory during this period were able to capitalize on corrective patterns amidst heightened market uncertainty.

Key Takeaways from the Brexit Referendum

- Corrective Patterns: After the referendum, markets showed clear A-B-C corrective waves. Traders used these patterns to predict retracements and potential reversals.

- Trading Adjustments: Options traders modified their strategies by entering long put options during wave B, expecting a further decline as wave C unfolded. This helped in protecting against potential losses while profiting from the expected downward movement.

GameStop Short Squeeze (2021)

The GameStop short squeeze of 2021 demonstrated the power of retail investor influence and precise timing based on wave patterns. Retail investors leveraged Elliott Wave Theory to navigate the highly volatile environment.

Insights from the GameStop Short Squeeze

- Precise Timing: By identifying impulsive waves early, traders positioned themselves advantageously for the rapid price surges driven by retail buying frenzy.

- Retail Investor Influence: The collective action of retail investors created a self-reinforcing cycle of impulsive waves, which savvy traders recognized and exploited for significant gains.

These case studies highlight how Elliott Wave Theory can be a valuable tool for making informed trading decisions during periods of market volatility and unexpected events. It’s important to note that during such times, market makers play a crucial role in options trading, ensuring liquidity and facilitating smoother transactions.

Conclusion

Integrating strategies based on Elliott Wave Theory can significantly elevate your options trading game. By mastering analysis of wave patterns, you gain a valuable tool for predicting market movements and making informed decisions.

However, mastering this technique requires diligent practice and continuous learning. The complexity of wave identification and structure demands dedication, but the rewards can be substantial.

Navigate markets with confidence using Elliott Wave Theory and these additional strategies, transforming uncertainties into opportunities. Embrace the power of this approach to enhance your success in options trading!