Market Reversals: How To Deal With Them, How To Adjust Your Options Strategies

Market reversals can present both challenges and opportunities for options traders. Being able to identify potential market reversals and adjust your options strategies accordingly is crucial for success in the ever-changing market landscape. In this article, we will explore different techniques for identifying market reversals, understand the concept of risk reversal in options strategy, and discuss how to implement a risk reversal strategy effectively.

Key Takeaways:

- Market reversals occur when the direction of a stock or asset’s trend changes.

- Identifying market reversals can be done through techniques such as the “sushi roll” pattern, trendline breaks, and signs of accumulation or distribution.

- Understanding risk reversal in options strategy is essential for managing risk during market reversals.

- A risk reversal strategy involves buying a call option and selling a put option, or vice versa, to offset potential losses.

- Maintaining and exiting a risk reversal strategy requires regular monitoring and evaluation of market conditions.

Identifying Market Reversals: Signals to Look For

When it comes to options trading, one of the key challenges is identifying market reversals and anticipating changes in trend direction. By being able to spot market reversal signals, traders can adjust their strategies and make informed decisions. Here, we will explore some common indicators or signals that traders can look for when anticipating a market reversal.

One widely recognized signal is the “sushi roll” pattern. This pattern consists of a series of inside and outside bars and can indicate a potential reversal in an existing trend. When the sushi roll pattern emerges in a downtrend, it may signal an opportunity to enter a long position or exit a short position. Conversely, if the pattern emerges in an uptrend, it may indicate an opportunity to sell a long position or enter a short position.

In addition to the sushi roll pattern, traders should also pay attention to signs of accumulation or distribution, such as springs and upthrusts. These can provide insights into potential market reversals. Furthermore, the breaking of a trendline can be a strong signal of a market reversal, indicating a shift in the overall trend direction. By keeping a close eye on these signals, traders can increase their chances of successfully identifying market reversals.

“The sushi roll pattern and signs of accumulation or distribution can provide valuable insights into potential market reversals.”

It is important to note that while these signals can be helpful, they are not foolproof. Traders should always combine them with other technical analysis tools and indicators to confirm their predictions. Additionally, market reversals can be unpredictable and may not always conform to expected patterns. Therefore, it is crucial to continuously monitor market conditions and adjust strategies accordingly.

Table: Common Signals for Identifying Market Reversals

| Signal | Description |

|---|---|

| Sushi Roll Pattern | A series of inside and outside bars indicating a potential reversal in trend direction. |

| Accumulation or Distribution | Signs of buying or selling pressure that can suggest a market reversal. |

| Trendline Break | The breaking of a trendline, indicating a shift in the overall trend direction. |

By paying close attention to these signals and combining them with proper technical analysis, traders can improve their ability to identify market reversals and make more informed decisions in their options trading.

Implementing a Risk Reversal Strategy

Implementing a risk reversal strategy is a crucial component of options trading, especially during market reversals. This strategy allows traders to protect their positions from potential losses while still maintaining the potential for profit. To implement a risk reversal strategy, traders need to evaluate the impact of the strategy on their overall portfolio performance and calculate the potential profit/loss and breakeven point.

Calculating the potential profit/loss in a risk reversal strategy involves considering the strike prices of the options and the premium paid or received. By understanding the potential risks and rewards, traders can determine if the risk reversal strategy is suitable for their specific market conditions. It is important to carefully analyze the potential impact of the strategy and make informed decisions about its implementation.

Determining the breakeven point in a risk reversal strategy is also essential. The breakeven point is the point at which the strategy neither makes a profit nor incurs a loss. By knowing the breakeven point, traders can assess the potential profitability of the strategy based on different market scenarios.

Overall, implementing a risk reversal strategy requires careful evaluation and analysis. Traders need to understand the potential impact, calculate the potential profit/loss, and determine the breakeven point. By doing so, traders can effectively manage risk during market reversals and make informed decisions about their options positions.

Table: Risk Reversal Strategy Example

| Options Position | Strike Price | Premium |

|---|---|---|

| Buy Call Option | $50 | $2 |

| Sell Put Option | $45 | $1.5 |

In this example, a trader buys a call option with a strike price of $50 and a premium of $2. They also sell a put option with a strike price of $45 and a premium of $1.5. This risk reversal strategy allows the trader to limit their potential losses if the market reverses while still maintaining the potential for profit. By combining both a call option and a put option, the trader can potentially profit from both upward and downward price movements.

Practical Examples of Risk Reversal Strategy

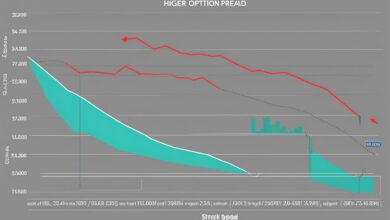

In order to better grasp how a risk reversal strategy can be implemented, let’s illustrate it with a practical example. Imagine you have a bullish outlook on a particular stock, but you want to protect yourself from a potential market reversal. You can employ a risk reversal strategy by buying a call option with a higher strike price and selling a put option with a lower strike price.

This approach allows you to limit your potential losses in case the stock reverses its direction, while still retaining the potential for profit if the stock continues to rise. Essentially, by employing a risk reversal strategy, you are insuring your position against a downward move in the stock price.

| Options Position | Profit/Loss |

|---|---|

| Buy Call Option | Unlimited profit potential |

| Sell Put Option | Limited loss potential |

As shown in the table above, this strategy allows you to maintain the potential for unlimited profits through the call option, while limiting your potential losses with the put option. By combining these two options positions, you can effectively manage your risk during market reversals.

It is important to note that different options strategies may be more suitable for different market conditions, so it is crucial to carefully consider the specific circumstances before implementing a risk reversal strategy. Additionally, keep in mind that while the risk reversal strategy can provide downside protection, it is not foolproof and there are always inherent risks involved in options trading.

Maintenance and Exit Strategy for Risk Reversal

When implementing a risk reversal strategy, it is crucial to have a well-defined maintenance and exit strategy. This involves regularly monitoring market conditions and the performance of your options positions. By staying vigilant, you can proactively respond to changing market dynamics and minimize potential risks.

One important aspect of maintenance is to regularly evaluate the risk/reward profile of your risk reversal strategy. If the market conditions change and the strategy is no longer favorable, it may be necessary to exit the position. This could involve closing out the options positions and potentially taking a loss. By being proactive, you can limit potential downside and protect your overall portfolio.

Another aspect of maintenance is to regularly assess the impact of the risk reversal strategy on your overall portfolio. This involves monitoring the performance of your options positions and adjusting your positions accordingly. By doing so, you can ensure that your risk reversal strategy aligns with your investment goals and risk tolerance.

Having a clear exit strategy is equally important. If the market does not reverse as anticipated or if the risk/reward profile becomes unfavorable, it may be necessary to exit the position. By having predefined exit criteria, you can make informed decisions and avoid emotional responses to market fluctuations. This disciplined approach can help you protect your capital and improve your long-term success as an options trader.

| Key Points | Benefits | Considerations |

|---|---|---|

| Regularly monitor market conditions and the performance of options positions | Minimize potential risks and protect overall portfolio | Requires time and effort for monitoring and analysis |

| Evaluate risk/reward profile of risk reversal strategy | Exit position if strategy is no longer favorable | Potential for taking a loss |

| Assess impact of risk reversal strategy on overall portfolio | Ensure strategy aligns with investment goals and risk tolerance | Requires ongoing monitoring and adjustments |

| Have a predefined exit strategy | Make informed decisions and avoid emotional responses | Discipline required to stick to the exit criteria |

By having a robust maintenance and exit strategy for your risk reversal positions, you can effectively manage your risk during market reversals and make informed decisions. This disciplined approach can help you navigate market fluctuations and improve your overall trading performance.

Advantages and Disadvantages of Risk Reversal Strategy

Implementing a risk reversal strategy in options trading comes with both advantages and disadvantages. Understanding these pros and cons is crucial for traders to make informed decisions about whether to use this strategy or not.

Advantages of Risk Reversal Strategy:

- Downside Protection: One of the main advantages of the risk reversal strategy is that it allows traders to protect their positions from potential losses during market reversals. By combining a call option and a put option, traders can limit their downside risk.

- Flexibility: The risk reversal strategy offers flexibility in options positions. It allows traders to potentially profit from both upward and downward price movements. This flexibility can be beneficial in volatile market conditions.

Disadvantages of Risk Reversal Strategy:

- Higher Transaction Costs: Implementing a risk reversal strategy involves buying and selling multiple options positions. This can lead to higher transaction costs for traders, which can eat into potential profits.

- Potential for Losses: If the market does not reverse as anticipated, traders may incur losses on both the call and put options positions. It is important to carefully assess market conditions and risks before implementing a risk reversal strategy.

By carefully considering the advantages and disadvantages of the risk reversal strategy, traders can determine if it aligns with their trading goals and risk tolerance. It is important to weigh the potential benefits against the potential drawbacks and make decisions based on individual circumstances.

Conclusion

The risk reversal strategy can be a valuable tool for options traders during market reversals. It provides downside protection and flexibility in options positions. However, traders should be aware of the higher transaction costs and the potential for losses if the market does not reverse as anticipated. By understanding the advantages and disadvantages of the risk reversal strategy, traders can make more informed decisions and adapt their strategies accordingly to navigate market turning points effectively.

The Importance of Understanding Risk Reversal in Options Strategy

Understanding risk reversal is crucial in options strategy because it allows us to effectively manage our risk during market reversals. Market reversals can lead to significant price movements and potential losses for traders who are not prepared. By implementing a risk reversal strategy, we can protect our positions and potentially profit from market reversals. This strategy allows us to limit our downside risk while still maintaining the potential for profit. It is important for options traders to have a solid understanding of how risk reversal works and when it is appropriate to use in their trading strategy. By understanding risk reversal, we can make more informed decisions about our options positions and effectively manage our risk.

One of the key reasons why understanding risk reversal is crucial is that it provides us with a way to protect our positions during market reversals. When a market reversal occurs, there is a high probability of price movements that can lead to potential losses. By implementing a risk reversal strategy, we can offset the risk of a potential price reversal by simultaneously buying a call option and selling a put option, or vice versa. This allows us to limit our potential losses while still maintaining the potential for profit.

Additionally, understanding risk reversal helps us to maintain flexibility in our options positions. By combining both a call option and a put option, we can potentially profit from both upward and downward price movements. This flexibility allows us to adapt to changing market conditions and adjust our strategies accordingly. It is important to note that different options strategies may be more suitable for different market conditions, so it is important to carefully consider the specific circumstances before implementing a risk reversal strategy.

| Risk Reversal Strategy | Advantages | Disadvantages |

|---|---|---|

| Protection against potential losses | – Limit downside risk – Maintain potential for profit |

– Higher transaction costs – Potential losses if market does not reverse as anticipated |

| Flexibility in options positions | – Profit from both upward and downward price movements |

By understanding the advantages and disadvantages of the risk reversal strategy, we can make more informed decisions about our options trading. It is important to carefully consider our risk tolerance and trading goals before implementing a risk reversal strategy. With a solid understanding of risk reversal, we can effectively manage our risk during market reversals and improve our chances of success in options trading.

Market Reversals and Their Impact on Options Trading

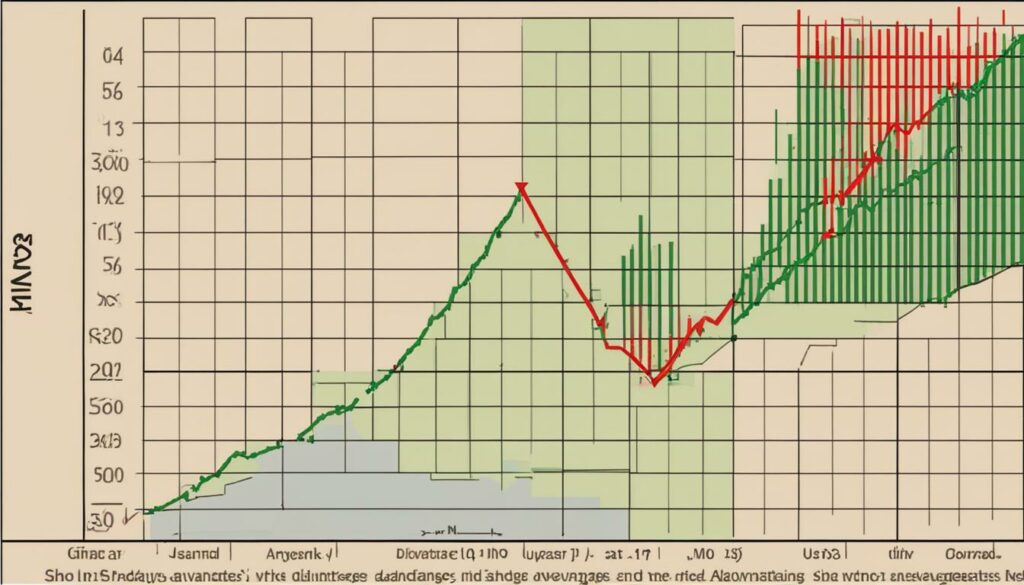

Market reversals, which are changes in the direction of a stock or asset’s trend, can have a significant impact on options trading. During a market reversal, traders need to adjust their strategies to adapt to the changing market conditions. This means identifying market reversal signals and implementing appropriate options strategies to capitalize on potential opportunities or mitigate risks. Let’s explore some common options strategies used during market reversals and alternative approaches for dealing with these market conditions.

Common Options Strategies for Market Reversals

When facing a market reversal, options traders often rely on various strategies to profit from or protect against potential price movements. Some commonly used options strategies during market reversals include:

- Vertical Spreads: This strategy involves buying and selling options contracts with different strike prices but the same expiration date to take advantage of anticipated price movements.

- Straddles: Traders use this strategy by simultaneously buying both a call option and a put option with the same strike price and expiration date to profit from significant price swings.

- Collars: A collar strategy combines the purchase of a protective put option with the sale of a covered call option to limit potential losses while capping potential gains.

These strategies allow traders to leverage market reversals for profit or protect their positions from potential losses.

Alternative Strategies for Dealing with Market Reversals

While the aforementioned options strategies are commonly employed during market reversals, traders may also consider alternative approaches to navigate changing market conditions. Some alternative strategies include:

- Hedging: Traders can hedge their positions by using options or other financial instruments to offset potential losses in a market reversal.

- Options on Stock Indexes: Instead of trading options on individual stocks, traders can consider using options on stock indexes to diversify their exposure and reduce the impact of individual stock price movements.

These alternative strategies offer different ways to manage risk and profit from market reversals, depending on traders’ preferences and risk tolerance.

| Pros | Cons | |

|---|---|---|

| Common Options Strategies | Opportunities for profit | Potential losses if market reversal doesn’t occur as anticipated |

| Alternative Strategies | Different risk management approaches | May require additional expertise or analysis |

When dealing with market reversals, it is essential for options traders to stay informed, understand the risks associated with each strategy, and carefully evaluate the suitability of a particular approach for their specific trading goals and risk tolerance.

Minimizing Risk During a Market Reversal

When facing a market reversal, it is crucial for traders to minimize their risk and protect their positions. By implementing a risk reversal strategy, traders can effectively manage their exposure to potential losses while still maintaining the potential for profit. There are several steps that traders can take to minimize risk during a market reversal.

Firstly, regular evaluation of the impact of the risk reversal strategy is essential. Traders should closely monitor the performance of their options positions and assess whether the risk/reward profile remains favorable. If the market conditions change and the strategy is no longer advantageous, it may be necessary to exit the position to limit potential losses.

Additionally, having a clear maintenance and exit strategy is crucial. Traders must establish predetermined criteria for when to exit a risk reversal position. This can involve setting targets for profit-taking or stop-loss levels to limit potential losses. By having a well-defined exit strategy, traders can make disciplined decisions based on predetermined criteria rather than emotional reactions to market movements.

Finally, it is important to avoid common mistakes when using the risk reversal strategy. These include failing to regularly evaluate the impact of the strategy on overall portfolio performance, not having a clear maintenance and exit strategy, and not adjusting positions as market conditions change. By learning from these mistakes and being proactive in managing risk, traders can increase their chances of success during market reversals.

Table: Common Mistakes to Avoid in Risk Reversal Strategy

| Mistake | Solution |

|---|---|

| Failing to regularly evaluate the impact of the strategy on portfolio performance | Regularly monitor the performance of options positions and assess whether the risk/reward profile remains favorable. |

| Not having a clear maintenance and exit strategy | Establish predetermined criteria for when to exit a risk reversal position based on profit-taking targets or stop-loss levels. |

| Not adjusting positions as market conditions change | Adapt positions based on changing market conditions to minimize risk and maximize potential profit. |

By minimizing risk during a market reversal through the implementation of a risk reversal strategy, having a clear maintenance and exit strategy, and avoiding common mistakes, options traders can navigate volatile market conditions with greater confidence and improve their overall trading performance.

Conclusion

Market reversals can present both challenges and opportunities for options traders. By understanding market reversal signals and implementing appropriate strategies, traders can navigate these turning points effectively. One such strategy is the risk reversal, which offers advantages in terms of downside protection and flexibility.

However, it is important to consider the disadvantages of the risk reversal strategy, such as higher transaction costs and the potential for losses if the market does not reverse as anticipated. Traders should carefully assess the risk-reward profile and suitability of the strategy based on their specific trading goals and risk tolerance.

Overall, understanding the significance of risk reversal in market reversals is crucial for options traders. By staying knowledgeable about various option trading strategies and adjusting their approaches to changing market conditions, traders can position themselves for success in dynamic market environments.

FAQ

What is a market reversal?

A market reversal is when the direction of a stock or asset’s trend changes.

How can traders identify potential market reversals?

Traders can look for signals such as the “sushi roll” pattern, breaking of trendlines, and signs of accumulation or distribution.

What is the risk reversal strategy?

The risk reversal strategy involves simultaneously buying a call option and selling a put option, or vice versa, to protect positions from potential losses during market reversals.

How can traders implement a risk reversal strategy?

Traders need to calculate potential profit/loss, determine the breakeven point, and evaluate the impact of the strategy on their options trading.

Can you provide a practical example of the risk reversal strategy?

Sure, a practical example would be buying a call option with a higher strike price and selling a put option with a lower strike price to protect a bullish position from potential losses.

What is a maintenance and exit strategy for risk reversal?

It involves regularly monitoring market conditions, evaluating performance, and adjusting positions if necessary.

What are the advantages of the risk reversal strategy?

The advantages include downside protection, flexibility, and potential profit from both upward and downward price movements.

What are the disadvantages of the risk reversal strategy?

The disadvantages include higher transaction costs and potential losses if the market does not reverse as anticipated.

Why is understanding risk reversal crucial in options strategy?

Understanding risk reversal helps traders effectively manage risk during market reversals and make informed decisions about their options positions.

How do market reversals impact options trading?

Market reversals require traders to adjust their options strategies to adapt to changing market conditions.

How can traders minimize risk during a market reversal?

Traders can minimize risk by implementing a risk reversal strategy, having a maintenance and exit strategy, and avoiding common mistakes.