What Is A Straddle?

A straddle is a trading strategy that involves buying/selling a Call option and a Put option simultaneously for the same underlying asset. Both options have the same expiry date and strike price. The purpose of a straddle is to profit from a big price change in the underlying asset, regardless of the direction of the movement. This strategy is used in volatile markets when the price movement is uncertain. A long straddle involves buying both options, while a short straddle involves selling both options.

Key Takeaways:

- A straddle strategy involves buying/selling both a Call option and a Put option for the same underlying asset.

- Straddles are used to profit from significant price changes, regardless of the direction of the movement.

- A long straddle involves buying both options, while a short straddle involves selling both options.

- Straddles are most effective in volatile markets with uncertain price movement.

- Straddle strategies carry both profit potential and risk, and should be carefully evaluated.

How Does a Straddle Work?

In a straddle strategy, a trader can either buy or sell call/put options on the same underlying asset, at the same strike price, and with the same expiry date. The trader hopes to benefit from high price variations, where the new values of the options are significantly higher or lower than their initial values. The cost of a straddle is the sum of the premiums paid or received for both options. If the price movement is in favor of the trader, they can make a profit. The outcome of a straddle strategy depends on the degree of price movement, rather than the direction of the movement.

Implementing a straddle position involves taking a stance in the options market that profits from volatility and uncertainty. Instead of predicting the direction of the underlying asset’s price movement, the straddle strategy focuses on capturing large price swings. This can be particularly advantageous in volatile markets or during periods of significant news announcements or economic events. By holding both a call and a put option, the trader can potentially profit from a market upswing or downswing, regardless of the specific direction in which the market moves.

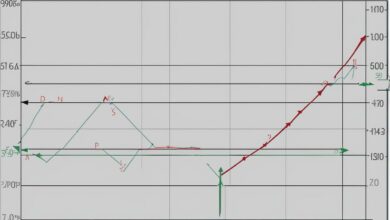

Let’s consider an example to illustrate the payoff of a straddle position. Suppose a trader buys a straddle on Company XYZ stock, which is currently trading at $50. The trader purchases both a call option with a strike price of $55 and a put option with a strike price of $45, both expiring in one month. The total cost of the straddle, including the premiums for both options, is $6. If the stock price moves above $61 or below $39 at expiration, the trader will start to profit. The potential profit is unlimited if the stock price moves significantly in either direction, higher or lower than the strike prices, mitigating the risk of taking a directional bet.

| Scenario | Stock Price | Call Option Payoff | Put Option Payoff | Total Payoff |

|---|---|---|---|---|

| Stock Price below $39 | $38 | $0 | $7 | $7 |

| Stock Price between $39 and $45 | $42 | $0 | $3 | $3 |

| Stock Price between $45 and $55 | $50 | $0 | $0 | $0 |

| Stock Price between $55 and $61 | $59 | $4 | $0 | $4 |

| Stock Price above $61 | $65 | $10 | $0 | $10 |

Long Straddle vs. Short Straddle

When implementing a straddle strategy, traders have the option to choose between a long straddle and a short straddle. While both strategies involve buying or selling both a call option and a put option, they differ in their profit potential and risk exposure. Understanding the differences between the two is crucial for successful straddle trading.

Long Straddle

A long straddle involves buying both a call option and a put option on the same underlying asset, with the same strike price and expiry date. The goal of a long straddle is to profit from a significant price movement in either direction. If the price of the underlying asset rises substantially, the call option can be exercised for a profit. Conversely, if the price decreases significantly, the put option can be exercised for a profit. Therefore, the trader profits from volatility, rather than the direction of the price movement.

Short Straddle

On the other hand, a short straddle involves selling both a call option and a put option on the same underlying asset, with the same strike price and expiry date. The trader profits from a lack of significant price movement in the underlying asset. If the price of the asset remains relatively stable and stays near the strike price, both options will expire worthless, allowing the trader to keep the premiums received for selling the options. However, the risk is unlimited in a short straddle, as the price of the underlying asset can move significantly against the trader, resulting in potentially large losses.

Overall, the choice between a long straddle and a short straddle depends on the trader’s outlook for the underlying asset and their risk tolerance. A long straddle offers unlimited profit potential but carries a limited risk, while a short straddle can provide upfront premium income but carries unlimited risk. Traders should carefully assess their market expectations and risk appetite before deciding which straddle strategy to employ.

| Strategy | Profit Potential | Risk Exposure |

|---|---|---|

| Long Straddle | Unlimited | Limited to the cost of the straddle |

| Short Straddle | Limited to the premiums received | Unlimited |

Factors Affecting Straddle Profitability

A straddle strategy can be a profitable approach in volatile markets, but its success is influenced by several key factors. Understanding and considering these factors is crucial for maximizing the potential profitability of a straddle strategy.

Volatility Strategy

Volatility plays a significant role in the effectiveness of a straddle strategy. Straddles are most effective in high volatility environments, where there is a greater likelihood of significant price movements in the underlying asset. Increased volatility provides more opportunities for the options to move into a profitable position, and thus enhances the chances of a successful straddle. Traders often use implied volatility as an indicator to determine the optimal time to enter or exit a straddle position.

Straddle Hedging

Another important consideration for straddle profitability is the ability to hedge against potential risks. Hedging involves taking offsetting positions to minimize the impact of adverse price movements. Traders can use options or other derivatives to mitigate the risk of a straddle strategy. By combining a straddle with a hedging strategy, traders can protect their positions and reduce the potential losses from unexpected market movements.

Straddle Risk

Like any investment strategy, a straddle comes with its own set of risks. It is important to assess and understand the potential risks associated with a straddle strategy before implementing it. The risk of a straddle lies in the possibility of the underlying asset’s price not moving significantly enough to generate a profit. Additionally, the cost of the straddle, including the premiums paid for both options, must be considered when evaluating profitability. Traders should carefully weigh the potential rewards against the risks involved in a straddle strategy and make informed decisions accordingly.

| Factors | Influence on Straddle Profitability |

|---|---|

| Volatility | High volatility increases the chances of profitable price movements. |

| Straddle Hedging | Effective hedging strategies can mitigate risks and protect against significant losses. |

| Straddle Risk | Traders must carefully consider the potential risks and rewards associated with a straddle strategy. |

Benefits of a Long Straddle

A long straddle can offer several benefits to options investors looking to profit from significant price movements in either direction. By simultaneously buying a call option and a put option on the same underlying asset with the same strike price and expiry date, investors can position themselves to capitalize on market volatility without having to predict the direction of the price change.

One of the primary advantages of a long straddle is the potential for unlimited upside profit. If the price of the underlying asset rises significantly, the call option can generate substantial gains. On the other hand, if the price drops significantly, the put option can provide a profitable outcome. This flexibility allows investors to profit from both bullish and bearish market scenarios.

“The long straddle strategy can be a powerful tool for options investors. It allows them to benefit from extreme price movements, regardless of whether the market goes up or down.”

Additionally, a long straddle can be used to create a straddle spread by selling options with different strike prices. This strategy can help offset the initial cost of the straddle, potentially reducing the overall risk. By carefully selecting the strike prices for the sold options, investors can effectively manage their exposure and increase the likelihood of a profitable outcome.

It’s important to note that while a long straddle offers significant profit potential, it also carries risks. The cost of the straddle, including the premiums for both options, can erode profits if the price movement is not substantial enough to overcome this cost. Additionally, time decay can negatively impact the value of the options as the expiry date approaches. Therefore, proper timing and careful consideration of market conditions are crucial when implementing a long straddle strategy.

| Benefits of a Long Straddle |

|---|

| Potential for unlimited profit |

| Flexibility to profit from bullish and bearish scenarios |

| Ability to create a straddle spread to reduce risk |

| Timing and market conditions are crucial for success |

Risks of a Straddle Strategy

While a straddle strategy can be profitable, it is not without risks. In a long straddle, the maximum loss occurs when both options expire at-the-money, resulting in a loss equal to the total cost of the straddle. This means that the trader would lose the entire premium paid for both the call and put options. However, if the price movement is substantial in either direction, the potential profit can outweigh the initial cost.

On the other hand, in a short straddle, the risk is even greater. The trader profits from a lack of significant price movement, but if the market moves against them, the potential losses can be manifold. This is because the trader may need to buy back the options at a higher price if the price of the underlying asset moves significantly. It’s important to carefully consider the risk-reward ratio and have a solid risk management plan in place before implementing a short straddle strategy.

When evaluating the potential risks of a straddle strategy, it is important to consider not only the cost of the straddle, but also any additional expenses such as commissions and exchange taxes. These costs can impact the overall profitability of the strategy, especially if the price movement is not significant enough to offset these expenses. Traders should also closely monitor the implied volatility of the market, as this can impact the price of the options and the potential profitability of the straddle strategy.

“A straddle strategy can be a high-risk, high-reward approach to trading options. Traders should carefully consider their risk tolerance and financial goals before implementing this strategy.”

Table: Examples of Straddle Strategy Risk

| Scenario | Risk | Potential Outcome |

|---|---|---|

| Both options expire at-the-money | Maximum loss | Loss equal to the total cost of the straddle |

| Price movement is not substantial | Loss of premiums paid for both options | Potential profit may not outweigh the initial cost |

| Significant price movement against the trader | Potential losses can be manifold | May need to buy back options at a higher price |

Examples of Straddle Payoff

A straddle strategy can result in various payoffs depending on the price movement of the underlying asset. Here are a few examples to illustrate the potential outcomes of a straddle:

| Scenario | Put Option | Call Option | Profit/Loss |

|---|---|---|---|

| Scenario 1 | Expired Worthless | Profit | Positive |

| Scenario 2 | Profit | Expired Worthless | Positive |

| Scenario 3 | Expired Worthless | Expired Worthless | Loss |

Scenario 1: Suppose a trader purchases a long straddle on ABC Company with a strike price of $50. If the stock price at expiry is $60, the put option will expire worthless, while the call option will result in a profit. The trader can sell the call option and make a profit equal to the difference between the stock price and the strike price, minus the cost of the straddle.

Scenario 2: In another scenario, if the stock price at expiry is $40, the put option will result in a profit, while the call option will expire worthless. The trader can sell the put option and make a profit equal to the difference between the strike price and the stock price, minus the cost of the straddle.

Scenario 3: However, if the stock price at expiry is $50, the put option and the call option will both expire worthless. The trader will incur a loss equal to the cost of the straddle.

It’s important to note that these examples are simplified for illustrative purposes and do not take into account factors such as transaction costs and taxes. The actual payoff of a straddle will depend on the specific details of the options and the price movement of the underlying asset.

Timing a Straddle Strategy

Timing plays a crucial role in the success of a straddle strategy. It is important to enter a straddle when there is enough time to expiry and when the implied volatility of the options market is favorable. The timing of a straddle strategy depends on the market conditions and the trader’s analysis of future price movements.

In a straddle strategy, low implied volatility can be a signal to enter a long straddle, as it suggests that the market expects a significant price movement. The cost of the straddle, including the premiums for both the call and put options, may be lower during periods of low implied volatility, making it an opportune time to initiate the strategy.

On the other hand, high implied volatility can be a signal to enter a short straddle, as it suggests that the market expects price stability or a lack of significant price movement. The higher premiums received for selling both the call and put options can compensate for the increased risk associated with a short straddle.

It is important to note that timing a straddle strategy requires careful analysis and consideration of the options market and current conditions. It is also advisable to avoid holding a straddle until expiry, as the chances of failure are higher as the options approach their expiration date.

| Timing Factors | Long Straddle | Short Straddle |

|---|---|---|

| Implied Volatility | Low implied volatility | High implied volatility |

| Cost of Straddle | Lower premiums during low implied volatility | Higher premiums to compensate for increased risk |

| Time to Expiry | Enough time for potential price movement | Enough time for potential price stability |

Timing is crucial when implementing a straddle strategy. It is generally recommended to enter a straddle when there is enough time to expiry and when the implied volatility of the market is favorable. Low implied volatility can be a signal to enter a long straddle, while high implied volatility can be a signal to enter a short straddle. It is important to avoid holding a straddle until expiry, as the chances of failure are higher nearer to expiry.

Straddle Strategy Considerations

When considering a straddle strategy, there are several important factors that options investors should take into account. The success of this strategy relies on understanding and analyzing the implied volatility of the market, the time to expiry, and the cost of the straddle.

First and foremost, implied volatility plays a crucial role in the profitability of a straddle strategy. A straddle is most effective in high volatility environments, where there is a greater chance of significant price movement. Traders should evaluate the current level of implied volatility to determine the optimal time to enter a straddle position. Low implied volatility can present an opportunity for a long straddle, while high implied volatility may be more suitable for a short straddle.

The time to expiry is another important consideration. It is generally recommended to enter a straddle when there is sufficient time remaining until the options’ expiration date. Holding a straddle position until expiry can be risky, as the chances of failure are higher as the options approach their expiration date. Therefore, traders should carefully evaluate the time remaining until expiry and determine whether it aligns with their trading goals and risk tolerance.

Finally, the cost of the straddle should be carefully evaluated. The cost of a straddle includes the premiums paid for both the call and put options. Traders need to consider whether the potential profit from the straddle strategy justifies the initial investment. Additionally, it is important to factor in commissions and exchange taxes when determining the overall cost of the strategy. Traders should assess whether the potential rewards outweigh the costs involved in executing a straddle strategy.

Straddle Strategy Considerations Table

Below is a table summarizing the main considerations for a straddle strategy:

| Consideration | Description |

|---|---|

| Implied Volatility | High volatility environments are ideal for a straddle strategy. |

| Time to Expiry | Ensure sufficient time remains until options’ expiration date. |

| Cost of Straddle | Evaluate the cost of the straddle, including premiums, commissions, and fees. |

In conclusion, a straddle strategy can be a powerful tool in an options investor’s arsenal. However, it requires careful consideration of implied volatility, time to expiry, and the cost involved. By thoroughly analyzing these factors, options traders can make informed decisions when implementing a straddle strategy and potentially profit from significant price movements.

Conclusion

Straddle options can be a valuable strategy in the world of options trading, particularly in volatile markets. By simultaneously buying or selling both a call option and a put option for the same underlying asset, traders have the potential to profit from significant price movements regardless of the direction.

It is important, however, to approach straddle strategies with caution and to consider key factors such as market volatility, timing, and the cost of executing the strategy. High volatility environments are generally more favorable for straddle options, as they increase the likelihood of significant price movements.

Successful implementation of a straddle strategy requires careful timing. It’s advisable to enter a straddle when there is sufficient time until the expiry of the options, and when the implied volatility of the market is favorable. While a long straddle offers unlimited profit potential on the upside, a short straddle presents the risk of unlimited losses.

In summary, straddle options can be a powerful tool for traders seeking to capitalize on volatility. However, it is vital to have a comprehensive understanding of the risks involved and to carefully assess market conditions before implementing this strategy.

FAQ

What is a straddle?

A straddle is a trading strategy that involves buying/selling a Call option and a Put option simultaneously for the same underlying asset. Both options have the same expiry date and strike price. The purpose of a straddle is to profit from a big price change in the underlying asset, regardless of the direction of the movement.

How does a straddle work?

In a straddle strategy, a trader can either buy or sell call/put options on the same underlying asset, at the same strike price, and with the same expiry date. The trader hopes to benefit from high price variations, where the new values of the options are significantly higher or lower than their initial values. The cost of a straddle is the sum of the premiums paid or received for both options. If the price movement is in favor of the trader, they can make a profit. The outcome of a straddle strategy depends on the degree of price movement, rather than the direction of the movement.

What is the difference between a long straddle and a short straddle?

A long straddle involves buying both a call option and a put option, while a short straddle involves selling both options. In a long straddle, the trader profits from a significant price movement in either direction. The risk is limited to the cost of the straddle, which is the total premium paid for both options. In a short straddle, the trader profits from a lack of significant price movement. However, the risk is unlimited, as the trader may need to buy back the options at a higher price if the price of the underlying asset moves significantly.

What factors affect the profitability of a straddle strategy?

The profitability of a straddle strategy is affected by several factors. One of the key factors is volatility. A straddle is most effective in high volatility environments, where there is a greater chance of significant price movement. Implied volatility can be used as a signal to determine the best time to buy or sell options. Additionally, the cost of the straddle, including the premiums for both options, can impact profitability. It is important to consider the risk and potential losses associated with a straddle strategy, as it is not a risk-free proposition.

What are the benefits of a long straddle?

A long straddle can be beneficial for options investors seeking to profit from a significant price movement in either direction. The potential profit for a long straddle is unlimited on the upside, as the stock price can rise indefinitely. Additionally, a long straddle can be used to create a straddle spread, where the trader sells options with different strike prices to offset the cost of the initial purchase.

What are the risks of a straddle strategy?

While a straddle strategy can be profitable, it is not without risks. In a long straddle, the maximum loss occurs when both options expire at-the-money, resulting in a loss equal to the total cost of the straddle. In a short straddle, the risk is even greater, as the potential losses can be manifold. It is important to consider the cost of the straddle, as well as commissions and exchange taxes, when evaluating the potential risks and rewards of this strategy.

Can you provide examples of straddle payoff?

The payoff of a straddle depends on the price movement of the underlying asset. For example, if a trader purchases a long straddle on Tata Motors stock with a strike price of Rs 380 and the stock price at expiry is Rs 450, the put option will expire worthless and the call option will result in a profit of Rs 70. If the trader decides to exit the strategy before expiry, the payout will depend on the current prices of the options.

What is the importance of timing in a straddle strategy?

Timing is crucial when implementing a straddle strategy. It is generally recommended to enter a straddle when there is enough time to expiry and when the implied volatility of the market is favorable. Low implied volatility can be a signal to enter a long straddle, while high implied volatility can be a signal to enter a short straddle. It is important to avoid holding a straddle until expiry, as the chances of failure are higher nearer to expiry.

What should be considered when using a straddle strategy?

When considering a straddle strategy, it is important to take into account the implied volatility of the market, the time to expiry, and the cost of the straddle. It is also recommended to avoid implementing a straddle strategy in a dull market, as the chances of failure are higher. Straddle strategies can be used as part of a larger options trading strategy, but they should be approached with caution and a thorough understanding of the risks involved.