Understanding Volatility Surfaces in Options Trading

Introduction

Understanding volatility surfaces is crucial in options trading as it provides insights into market sentiment and pricing anomalies. By analyzing the implied volatilities across various strike prices and expiration dates, traders can better grasp the underlying risks and opportunities.

A volatility surface encapsulates market sentiment by illustrating how implied volatility varies with different strike prices and maturities. This 3D representation helps traders visualize discrepancies in market pricing, aiding in more informed decision-making.

However, it’s important to note the limitations of certain indicators, such as the MACD, which can provide false signals and be ineffective in sideways markets. Therefore, having a comprehensive understanding of these tools’ strengths and weaknesses is essential for successful trading.

The purpose of this article is to demystify volatility surfaces, explaining their components, analysis techniques, and practical applications. By diving deep into this topic, you’ll gain valuable knowledge to enhance your risk management strategies and optimize your trading decisions.

To stay updated with the latest stock market news, which could impact your trading decisions, make sure to regularly check reliable financial news sources. Additionally, understanding the different types of options brokers available can help you navigate options trading with confidence.

It’s also worth noting that a decrease in implied volatility can have significant consequences on your investment portfolio. Thus, exploring strategies to manage risks and maximize returns in a volatile market becomes imperative. For those looking to delve deeper into this topic or seeking further knowledge about options trading, there are numerous resources available online.

What are Volatility Surfaces?

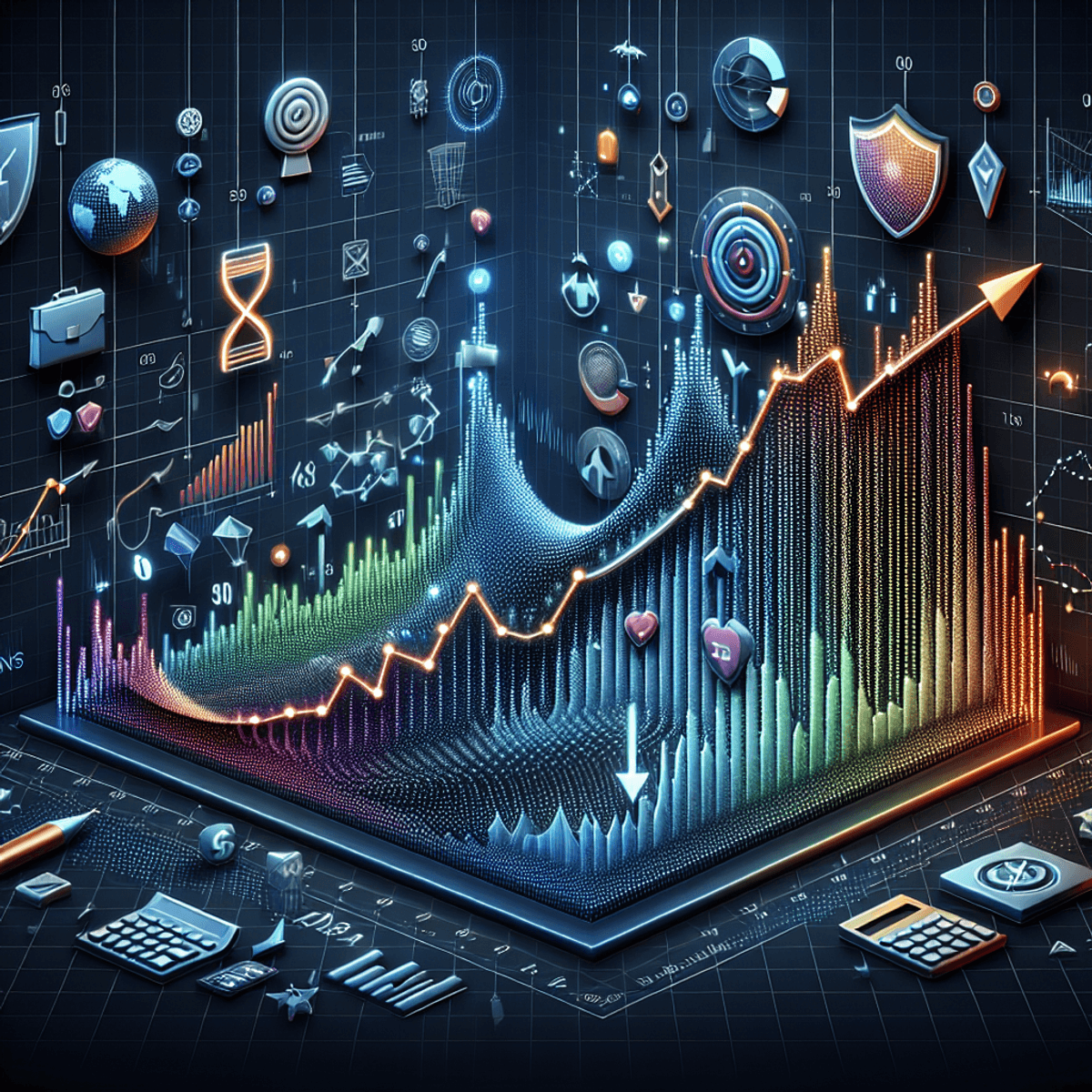

Volatility surfaces provide a three-dimensional visualization of implied volatilities for various options on the same underlying asset. This surface is crucial in options trading as it encapsulates market sentiment and helps traders understand pricing discrepancies.

3D Representation

- X-axis (Strike Price): Represents the strike prices of the options.

- Y-axis (Time to Expiration): Denotes different expiration dates.

- Z-axis/Color Gradient (Implied Volatility): Shows the implied volatility values.

This three-dimensional structure allows traders to see how implied volatility varies with changes in strike prices and expiration dates, providing a comprehensive view of option pricing relationships.

Significance

- Market Sentiment: The shape and dynamics of the volatility surface can indicate market expectations about future volatility.

- Pricing Relationships: Helps visualize how different options are priced relative to one another, facilitating better-informed trading decisions. For instance, understanding the relationship between call options and their pricing can be significantly enhanced by analyzing the volatility surface.

- Risk Management: Understanding these surfaces aids in assessing risk more accurately, leading to more effective hedging strategies. Knowledge of Option Greeks, which measure the sensitivity of an option, is vital in this aspect.

By examining these surfaces, you gain insights into implied volatility patterns and their impact on option prices, essential for strategic planning in options trading. Additionally, incorporating advanced pricing models like the Black Scholes Model can further refine your trading strategy. For those seeking to deepen their understanding of options trading, exploring these top books could prove beneficial.

Components of Volatility Surfaces

Understanding the components of volatility surfaces is crucial for making informed trading decisions. Two key components are volatility skew and term structure.

Volatility Skew

Volatility skew refers to the pattern of implied volatilities across different strike prices for options with the same expiration date. This phenomenon is observed because implied volatilities are not constant, often showing significant variation depending on strike prices.

Types of Volatility Skew

- Volatility Smile: A U-shaped curve where out-of-the-money (OTM) and in-the-money (ITM) options have higher implied volatilities than at-the-money (ATM) options.

- Volatility Smirk: A skewed pattern where OTM put options exhibit higher implied volatilities than OTM call options, creating an asymmetric shape rather than a balanced smile.

Causes of Volatility Skew

- Demand for Downside Protection: Investors often seek protection against market declines, leading to higher demand and thus higher implied volatilities for OTM puts.

- Leverage Effect: The negative correlation between asset returns and volatility can cause implied volatilities to increase as stock prices decrease, influencing the skew shape.

Volatility Term Structure

The volatility term structure represents how implied volatilities change with different expiration dates for options with the same strike price. This component helps traders understand how market expectations of future volatility evolve over time.

Types of Term Structure

- Normal Term Structure: Implied volatility increases with longer expiration dates, indicating higher uncertainty in the distant future.

- Inverted Term Structure: Implied volatility decreases with longer expiration dates, suggesting that near-term events are expected to create more volatility than long-term factors.

Factors Affecting Term Structure

- Market Conditions: Fluctuations in economic indicators or sudden market movements can significantly impact the term structure.

- Upcoming Events: Specific events like earnings announcements, economic reports, or geopolitical developments can create temporary spikes or dips in implied volatilities across different expiration dates.

Understanding these components—volatility skew and term structure—provides deeper insights into option pricing dynamics. It allows you to identify potential trading opportunities and manage risk more effectively by interpreting implied volatility variations accurately.

Analyzing Volatility Surfaces Effectively

Understanding how skew and term structure interact is crucial for effective analysis of volatility surfaces. Both components offer unique insights, but analyzing them together provides a more comprehensive view of market sentiment and potential trading opportunities.

Importance of Skew and Term Structure Interaction

- Volatility Skew: Indicates how implied volatility varies with strike prices. A pronounced skew can signal market expectations of significant price movements in one direction.

- Term Structure: Reflects changes in implied volatility across different expiration dates. This helps understand how market expectations evolve over time.

By analyzing these elements together, you can better anticipate price movements, manage risks, and devise strategies that align with current market conditions.

Techniques for Effective Analysis

- 3D Visualization Tools: Utilize platforms like Bloomberg or Thinkorswim to generate 3D plots of volatility surfaces. These visualizations help in identifying patterns and anomalies quickly.

- Historical Data Comparison: Examine historical volatility surfaces to spot recurring patterns or shifts in sentiment. This comparison aids in forecasting future movements based on past behavior.

- Statistical Models: Implement statistical tools such as GARCH (Generalized Autoregressive Conditional Heteroskedasticity) models to predict future volatility based on historical data.

- Scenario Analysis: Conduct scenario analyses to simulate how changes in market conditions might affect the volatility surface. This approach helps in preparing for various market scenarios.

Engaging with these techniques allows you to gain deeper insights into the dynamics of options pricing, thereby enhancing your trading strategies and risk management practices.

Trading Strategies Utilizing Volatility Surfaces

Strategies Exploiting Volatility Skew Dynamics:

- Put Spread Collars: This strategy involves holding a long position in the underlying asset, buying a protective put option, and selling a call option. It capitalizes on higher implied volatilities of out-of-the-money puts.

- Risk Reversal: This strategy involves buying an out-of-the-money call and selling an out-of-the-money put. It benefits from skew dynamics where put options have higher implied volatilities than calls, making it essential to understand option moneyness for maximizing profits.

- Butterfly Spreads: Combines multiple strike prices to create low-cost, limited-risk trades. Butterfly spreads are effective when the implied volatility is expected to remain within a narrow range.

Understanding these strategies helps traders leverage volatility surfaces for more informed decision-making. For those interested in mastering these techniques, this guide offers valuable insights into advanced trading strategies and best practices.

Additionally, if you’re considering selling a call option before its expiry date, it’s crucial to know that this is indeed possible, provided you understand the associated strategies and timing involved in option trades.

Practical Considerations for Traders when Using Volatility Surfaces in Options Trading

When trading based on volatility surfaces, several practical considerations can significantly impact your strategy’s effectiveness and execution. These aspects are crucial to ensure robust risk management, minimize transaction costs, and understand market liquidity.

Risk Management: Importance of Robust Practices

Effective risk management practices are essential when trading options using volatility surfaces. Key elements include:

- Position Sizing: Proper position sizing helps manage exposure and limits potential losses. It’s critical to balance between potential gains and the risk you’re willing to take.

- Scenario Analysis: Conducting scenario analysis allows you to anticipate how different market conditions might affect your positions. This includes evaluating the impact of significant events or shifts in market sentiment.

- Correlation Risk: Understanding how different assets correlate can help mitigate risks associated with multiple positions. Correlation risk becomes particularly important when managing a portfolio of options strategies.

- Rolling Positions: Adjusting or rolling positions over time helps maintain desired risk levels and respond to changing market conditions.

One effective way to manage risk is through delta hedging with straddle options, which can unlock market-neutral positions and provide a safeguard against adverse price movements.

Transaction Costs: How They Impact Strategy Effectiveness

Transaction costs can erode profits, making it essential to account for them in your strategy. Key factors include:

- Bid-Ask Spreads: The difference between the bid price and ask price represents a cost to enter or exit a trade. Wider spreads can reduce profitability, especially in less liquid markets.

- Commissions: Broker commissions add up, particularly if you trade frequently. It’s crucial to factor in these costs when calculating potential returns.

- Slippage: Slippage occurs when an order is executed at a price different from the expected price, often due to market movement. This can significantly affect your actual returns.

Market Liquidity: Understanding Its Role in Executing Trades

Market liquidity plays a pivotal role in executing trades efficiently:

- Option Liquidity: Highly liquid options have tighter bid-ask spreads and more stable prices, making it easier to enter or exit positions without significant price impact.

- Synthetic Positions: Creating synthetic positions (e.g., combining various options strategies) may require trading multiple options simultaneously. Ensuring sufficient liquidity for all components is vital to avoid adverse price movements.

In certain scenarios, advanced strategies like the iron butterfly options may also be employed for better risk definition and crafting well-defined setups.

Considering these factors — from robust risk management practices such as delta hedging, synthetic position creation, advanced strategies like iron butterfly options, understanding transaction costs and market liquidity — ensures that your trading strategies based on volatility surfaces are well-grounded and effective.

Conclusion

Understanding volatility surfaces is crucial in options trading. They are powerful tools for traders, providing insights into market sentiment and pricing relationships, such as intrinsic value, which is the difference between the current price of the underlying and the strike price. By mastering volatility surfaces, you can enhance your trading strategies and make more informed decisions.